How to Plan a Honeymoon & Save Big

Planning a honeymoon is an exciting journey, a celebration of love, and a chance to create unforgettable memories. However, the costs associated with a dream getaway can often feel overwhelming. Fortunately, with careful planning and strategic saving, you can experience the honeymoon of your dreams without breaking the bank. This guide will equip you with practical tips and actionable steps to plan an amazing honeymoon while maximizing your savings. From setting a realistic budget to exploring cost-cutting strategies and boosting your savings, discover how to make your honeymoon dreams a reality. The key is to start early, be organized, and remain flexible throughout the planning process. By following these steps, you’ll be well on your way to a romantic and memorable honeymoon that fits your budget.

Set Your Honeymoon Budget

The foundation of any successful honeymoon plan is a well-defined budget. Before you start dreaming about destinations, flights, or luxury accommodations, sit down with your partner and have an open and honest conversation about how much you can realistically afford to spend. Consider your current financial situation, existing debts, and other financial goals. Once you have a clear understanding of your financial capacity, you can begin to allocate funds to different aspects of your honeymoon. Itu2019s crucial to be realistic and account for all potential expenses, including flights, accommodation, food, activities, transportation, and any extras like souvenirs or spa treatments. A well-defined budget will not only guide your spending but also prevent overspending, helping you stay on track with your savings goals.

Determine Your Saving Timeline

The timeline for saving significantly impacts your ability to reach your honeymoon goals. The earlier you start saving, the more time you have to accumulate funds. Ideally, start saving as soon as you set your wedding date. This allows you to spread your savings over a longer period, making it easier to manage and reduce the pressure of a tight deadline. If you have less time, you might need to save more aggressively or consider a shorter, more budget-friendly trip. Review your wedding date and work backward to determine a realistic savings timeline. Consider the time needed to research destinations, book flights and accommodations, and plan activities. A well-defined timeline provides a clear roadmap for your savings efforts, keeping you motivated and on track.

Create a Detailed Budget Breakdown

Once you have a budget and a timeline, break down your budget into specific categories. This detailed breakdown gives you a clear picture of where your money will go and where you might be able to cut costs. Start by researching estimated costs for flights, accommodation, food, activities, and transportation in your chosen destination. Use online resources, travel blogs, and travel agencies to gather price estimates. Allocate a specific amount to each category, ensuring you include a contingency fund for unexpected expenses. Regularly review and adjust your budget as needed. As you research and book your honeymoon, track your spending against your budget to identify any potential overspending. This detailed breakdown allows you to stay in control of your finances and make informed decisions throughout the planning process.

Accommodation Costs

Accommodation can be a significant expense, but there are many ways to save without sacrificing comfort or quality. Consider alternative accommodation options like vacation rentals, Airbnb, or boutique hotels, which often offer better value than traditional hotels. Explore different locations and travel during the off-season or shoulder seasons to take advantage of lower rates. Compare prices from multiple sources and look for deals or promotions. Another option is to consider all-inclusive resorts, which can bundle accommodation, meals, and activities into one price. By researching and comparing various options, you can find accommodation that fits your budget while still providing a comfortable and enjoyable experience.

Flights and Transportation

Flights and transportation costs can vary widely depending on the destination, time of year, and booking method. To save money, be flexible with your travel dates and consider flying during the off-peak season. Use flight comparison websites to find the best deals and set price alerts to track any fluctuations in prices. Consider alternative airports, as they can sometimes offer lower fares. Look into budget airlines, but be sure to factor in baggage fees and other extra charges. Once you arrive, consider using public transportation, ride-sharing services, or rental cars, depending on your destination and budget. By comparing prices and exploring different options, you can significantly reduce your transportation costs, freeing up funds for other aspects of your honeymoon.

Food and Activities

Food and activities are essential for creating lasting memories on your honeymoon, but they can also be a significant drain on your budget if not managed properly. Research local restaurants and eateries to find affordable options, and consider cooking some meals yourself if your accommodation has kitchen facilities. Take advantage of free activities like exploring parks, hiking trails, or visiting local markets. Look for discounts on attractions, tours, and activities. Purchase city passes or attraction bundles if you plan to visit multiple attractions. Another great option is to pack your own snacks and drinks to avoid high prices at tourist locations. By planning your meals and activities carefully, you can enjoy your honeymoon without overspending on food and entertainment.

Explore Cutting Expenses

Identify areas where you can cut expenses without sacrificing the quality of your honeymoon. This could include reducing pre-wedding spending, negotiating deals and discounts, or choosing a less expensive destination. Consider alternatives to traditional wedding expenses like expensive flowers or extravagant favors. Be creative and look for ways to save money while still making your wedding and honeymoon special. By exploring different options, you’ll find opportunities to trim expenses and allocate the savings towards your honeymoon fund.

Reduce Pre-Wedding Spending

Wedding expenses can quickly add up, so reducing spending can free up funds for your honeymoon. Evaluate your wedding budget and identify areas where you can cut costs without compromising your vision. Consider options like DIY decorations, using in-season flowers, or choosing a less expensive venue. Prioritize what’s most important to you and be willing to compromise on other aspects. Look for deals on wedding vendors and negotiate prices whenever possible. By keeping your pre-wedding spending in check, you’ll have more money to put towards your dream honeymoon.

Negotiate Deals and Discounts

Negotiating deals and discounts can significantly reduce the cost of your honeymoon. When booking flights, accommodation, or activities, don’t be afraid to ask for a better price. Look for package deals that bundle multiple services, and inquire about any discounts for booking in advance. Explore options like travel rewards credit cards, which offer points or miles that can be redeemed for travel expenses. Check for discounts for students, seniors, or other groups you might be a part of. By being proactive and assertive, you can often find opportunities to save money and enhance your honeymoon experience.

Consider All-Inclusive Packages

All-inclusive packages can be a cost-effective option for your honeymoon. These packages often bundle accommodation, meals, drinks, and activities into one price, making it easier to budget and manage expenses. Research different all-inclusive resorts and compare the amenities, locations, and prices. Consider the value of the included features, such as food and beverage options, spa treatments, and entertainment. Before you book, read reviews and compare the total cost with other options. By choosing an all-inclusive package, you can enjoy a stress-free honeymoon, knowing that most of your expenses are already covered.

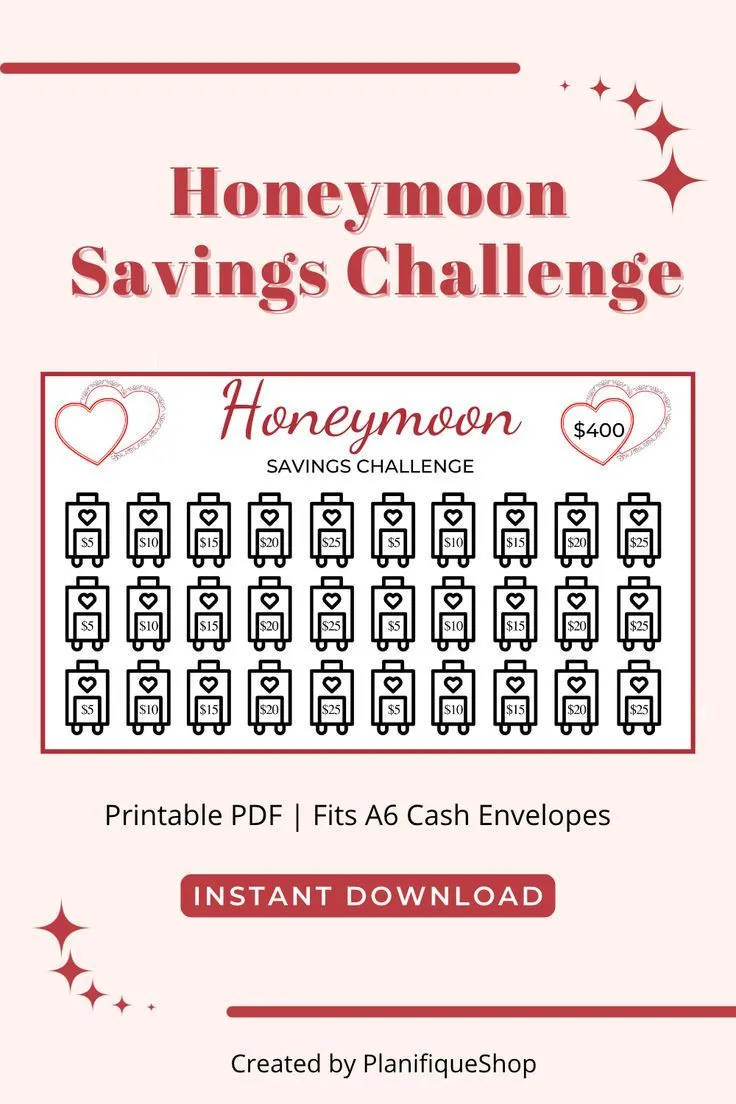

Track Your Savings Progress

Tracking your savings progress is crucial for staying motivated and ensuring you reach your honeymoon goals. Use budgeting apps, spreadsheets, or notebooks to monitor your income and expenses. Regularly review your budget and compare your actual savings to your target. Identify any areas where you’re overspending and adjust your budget as needed. Celebrate milestones along the way to maintain motivation. By tracking your progress, you stay informed and empowered to make smart financial decisions.

Use Savings Apps & Tools

Take advantage of technology to help you save money. Several savings apps and tools are designed to automate your savings, track your expenses, and offer insights into your spending habits. These tools can help you stay organized and on track with your honeymoon fund. Consider using apps that round up your purchases and transfer the spare change to your savings account. Explore budgeting apps that allow you to set goals, track your spending, and monitor your progress. These tools simplify your financial management, allowing you to focus on the excitement of planning your honeymoon.

Automate Your Savings

Automating your savings is an efficient way to ensure consistent contributions to your honeymoon fund. Set up automatic transfers from your checking account to your savings account each month. Choose a realistic amount that you can comfortably afford, and consider increasing the amount over time as your income grows. Some banks and credit unions offer tools that automatically transfer a percentage of your income to your savings account. By automating your savings, you eliminate the temptation to spend your money elsewhere and stay on track with your goals.

Boost Your Honeymoon Fund

If you’re looking to boost your honeymoon fund quickly, consider strategies to generate extra income. These could include taking on side hustles, selling unused items, or asking for contributions from friends and family. Every extra dollar you save brings you closer to your dream honeymoon.

Side Hustles for Extra Cash

Consider taking on a side hustle to generate extra income. This could include freelance work, online surveys, or driving for a ride-sharing service. Explore your skills and passions to find a side hustle that aligns with your interests. Set aside a specific amount of time each week for your side hustle, and dedicate the earnings to your honeymoon fund. This method allows you to increase your income without significantly disrupting your lifestyle. Websites like Upwork and Fiverr can help you find freelance opportunities, while platforms like Swagbucks and Survey Junkie provide opportunities for paid online surveys.

Sell Unused Items

Selling unused items is a quick way to raise money for your honeymoon. Go through your home and identify items you no longer need or use. These could include clothing, electronics, furniture, or other belongings. Sell these items through online marketplaces like eBay or Craigslist, or consider hosting a garage sale. Decide on a reasonable price for each item, and use the proceeds to boost your honeymoon fund. This method helps you declutter your home and earn money quickly.

Ask for Honeymoon Contributions

Don’t hesitate to ask for contributions from friends and family. Many couples create a honeymoon registry or suggest contributions in lieu of traditional wedding gifts. Make it easy for guests to contribute by providing a link to your registry or including information about your honeymoon fund on your wedding website. Be grateful for any contributions you receive, and remember that every little bit helps. Friends and family members often enjoy contributing to a couple’s special trip and can help make your honeymoon even more memorable.

Conclusion

Saving for a honeymoon requires planning, discipline, and a commitment to your financial goals. By setting a budget, exploring cost-cutting strategies, and boosting your savings, you can create an unforgettable honeymoon experience. Remember to start early, stay organized, and track your progress to stay on track. Be flexible and adapt your plans as needed, and don’t be afraid to seek advice and assistance from financial experts. With careful planning and consistent effort, your dream honeymoon is within reach, allowing you to celebrate your love and create memories that will last a lifetime.